A Dynamic Analysis of the Impact of Household Portfolio Allocation Decisions on the Demand for Life Insurance

DOI:

https://doi.org/10.61190/fsr.v31i4.3181Keywords:

panel data, life insurance, household portfolio; asset allocationAbstract

Prior research on the demand for life insurance in household portfolio holdings has not made a clear distinction between portfolio shifts resulting from active allocation decisions and those resulting from passive acceptance. Our study examines the relationship between household portfolio allocation decisions and the demand for life insurance in a dynamic setting, using panel data before and after the 2008 financial crisis. The study provides the first evidence that household decisions to invest in cash and cash equivalents, bonds, retirement assets, and pay off debts significantly affect life insurance ownership.

Downloads

Published

How to Cite

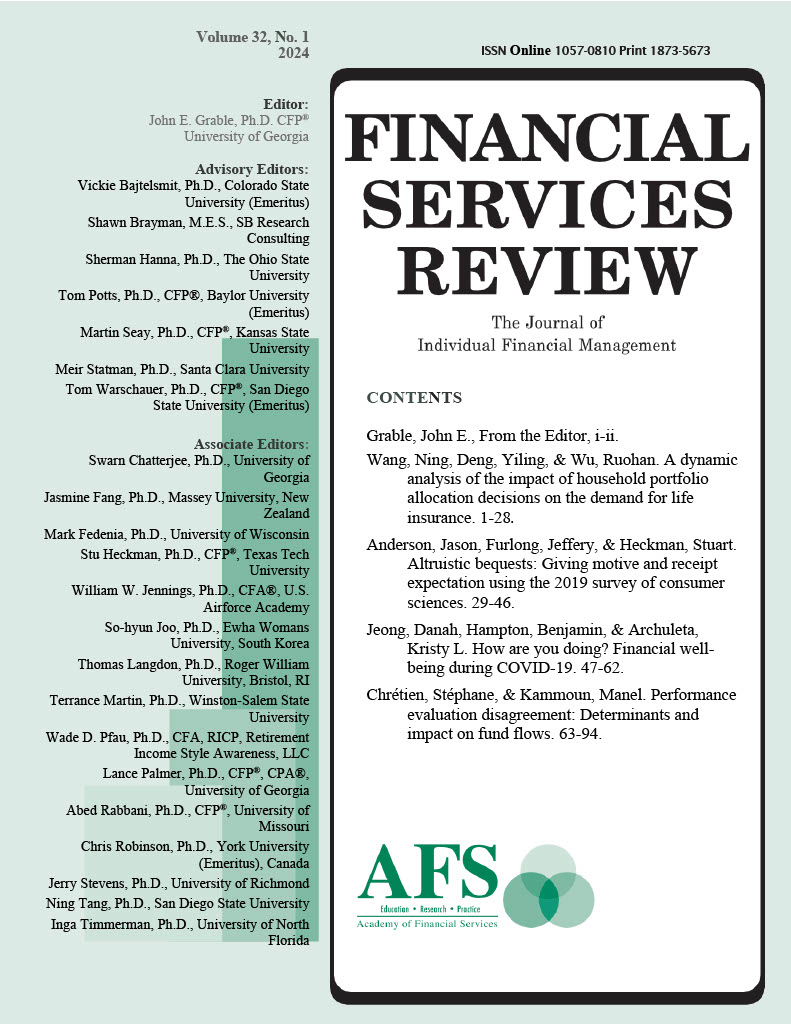

Issue

Section

License

Copyright (c) 2024 Ning Wang, Yiling Deng, Ruohan Wu

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

Author(s) retain copyright and grant the Journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-NonCommercial 4.0 International License that allows to share the work with an acknowledgment of the work's authorship and initial publication in this Journal.

This license allows the author to remix, tweak, and build upon the original work non-commercially. The new work(s) must be non-commercial and acknowledge the original work.