The evidence on target-date mutual funds

DOI:

https://doi.org/10.61190/fsr.v25i3.3223Keywords:

Target-date funds, Life cycle funds, Retirement, Asset allocationAbstract

This paper assimilates the knowledge and evidence on target-date mutual funds (TDFs). It begins with a discussion of the environment that contributes to the tremendous growth of TDFs. Next, a survey of the theory and recommendations on glide paths indicates a trend towards focusing on meeting retirement liabilities, rather than optimizing asset only portfolios. A review of performance evaluation metrics for TDFs shows that none of the available indexes possesses all seven characteristics of an ideal benchmark. Plan sponsors can provide better outcomes by offering multiple risk profile TDFs while researchers can focus on improving glide path and benchmark design.

Downloads

Published

How to Cite

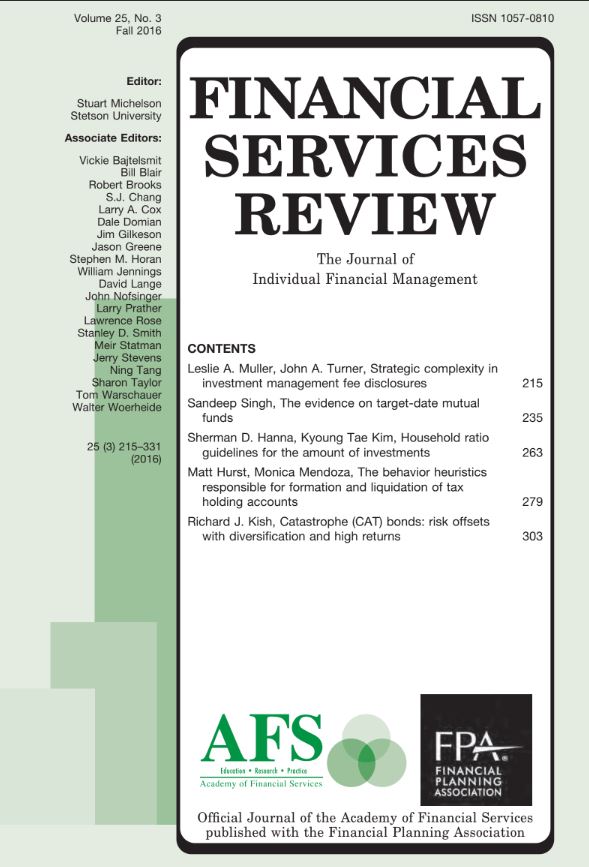

Issue

Section

License

Copyright (c) 2014 Academy of Financial Services

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

Author(s) retain copyright and grant the Journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-NonCommercial 4.0 International License that allows to share the work with an acknowledgment of the work's authorship and initial publication in this Journal.

This license allows the author to remix, tweak, and build upon the original work non-commercially. The new work(s) must be non-commercial and acknowledge the original work.