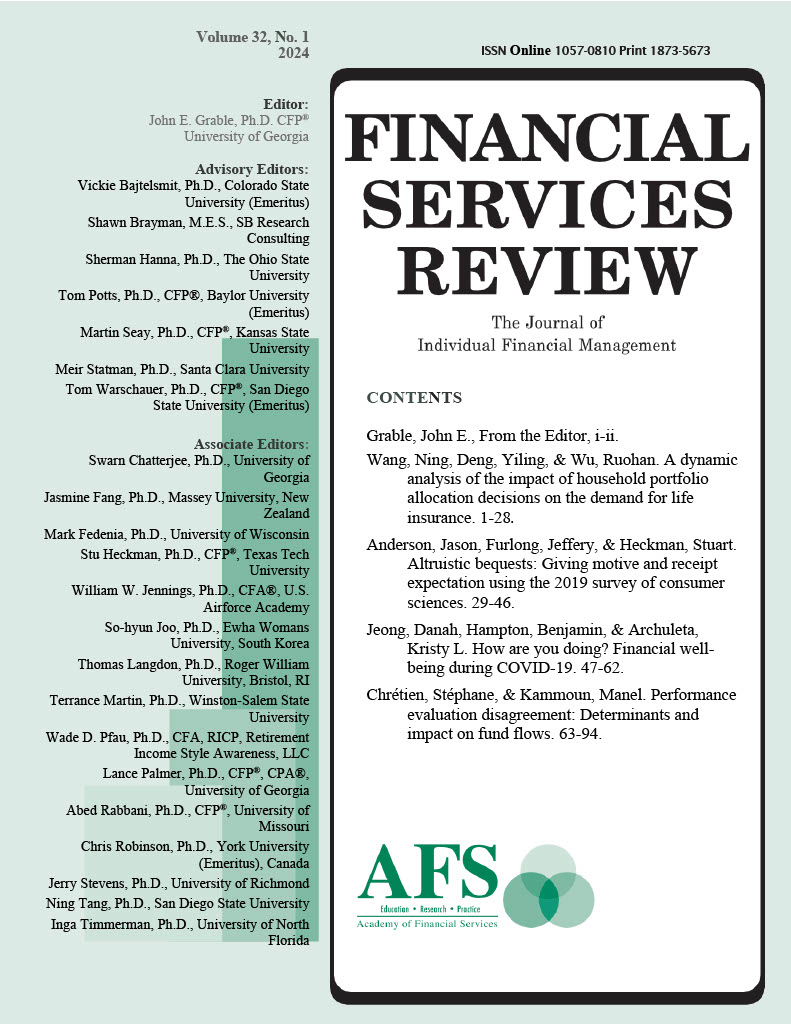

Performance Evaluation Disagreement

Determinants and Impact on Fund Flows

DOI:

https://doi.org/10.61190/fsr.v32i1.3230Keywords:

Investor disagreement, Performance evaluation, Mutual funds, Fund characteristics, Active management, Fund flowsAbstract

This paper studies investor disagreement in the performance evaluation of equity mutual funds by comparing two existing approaches and estimating its relations with fund characteristics, active management level and fund flows. We find that investors disagree more about the performance of funds that have higher expense ratio and turnover, lower manager tenure and dividend yield, and that are older, smaller and part of a larger family. Disagreement is also higher for funds that follow riskier investment style strategies and deviate more from their benchmarks. Finally, larger disagreement leads to more net fund flows. These findings suggest that heterogeneous investors do not value funds with aggressive active trading strategies similarly, and that favorable valuations by some clienteles result in positive demands for this type of management.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Stéphane Chrétien, Manel Kammoun

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

Author(s) retain copyright and grant the Journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-NonCommercial 4.0 International License that allows to share the work with an acknowledgment of the work's authorship and initial publication in this Journal.

This license allows the author to remix, tweak, and build upon the original work non-commercially. The new work(s) must be non-commercial and acknowledge the original work.