Household ratio guidelines for the amount of investments

DOI:

https://doi.org/10.61190/fsr.v25i3.3279Keywords:

Capital Accumulation Ratio, Financial ratios, Investing, Lifecycle theory of savings, Survey of Consumer FinancesAbstract

Some textbooks suggest using financial ratios to provide simple indicators of whether households are making appropriate financial decisions. We investigate three investment ratios mentioned in textbooks: investments to net worth, investments to annual income, and investments to total assets. We conduct regressions on respondent evaluation of the adequacy of retirement income, among households with a non-retired head in the 2013 Survey of Consumer Finances. The investments to total assets ratio has the strongest relationship to adequacy, controlling for selected household characteristics. The investments to net worth ratio (Capital Accumulation ratio) is inferior to the other two ratios.

Downloads

Published

How to Cite

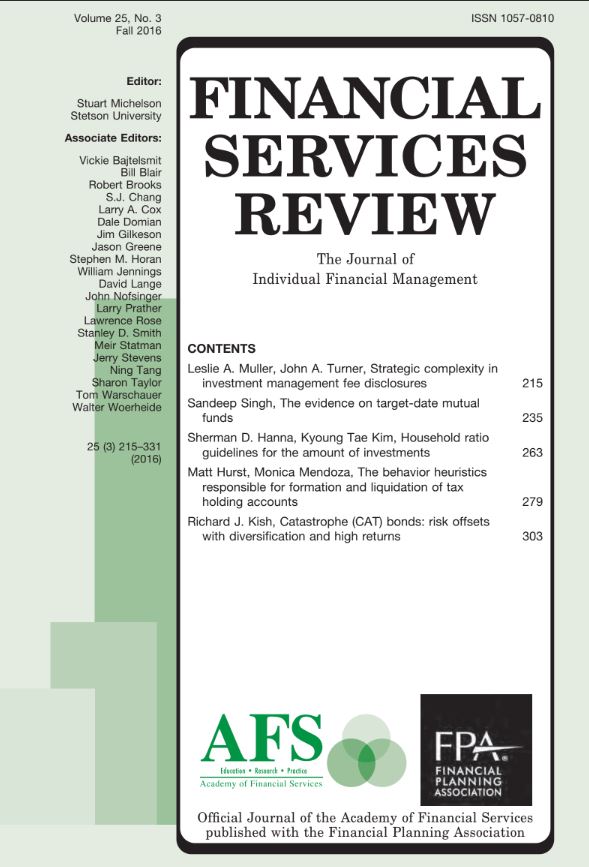

Issue

Section

License

Copyright (c) 2014 Academy of Financial Services

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

Author(s) retain copyright and grant the Journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-NonCommercial 4.0 International License that allows to share the work with an acknowledgment of the work's authorship and initial publication in this Journal.

This license allows the author to remix, tweak, and build upon the original work non-commercially. The new work(s) must be non-commercial and acknowledge the original work.